"vc 投资报告"相关数据

更新时间:2023-01-112016年Q2全球VC风险投资报告

Welcome message

The second quarter of 2016 saw venture capital market activity rise slightly following 2 quarters of dedlines. Large rounds by companies like Uber, Snapchat and Didi Chuxing helped buoy investment despite the ongoing dedine in the number of deals.

While the Brexit referendum in the UK caused many investors to hold back from making significant investments, over the quarter, specifically in the UK, the upcoming US presidential election, the potential increase in US interest rates, and an economic slowdown in China also added to investor caution.

Despite the further drop in the number of VC deals, there are strong indications that market activity will rebound heading into the second half of 2016 and into 2017. Many investors appear to be taking a 'wait-and-see' approach to the VC market rather than switching their investment focus entirely, ending the days Of FOMO (fear Of missing out).

In fact, many VC investors are using the current market climate as an impetus to raise additional funds, rethink their portfolio of investments and focus more diligently on identifying companies that have strong business models and plans to achiêve profitability. As market uncertainties resolve, these investors are expected to be looking to deploy the significant amount of dry powder they have accumulated over the past 6 months.

【更多详情,请下载:2016年Q2全球VC风险投资报告】

2021年和2022年中国互联网大厂在消费领域投资布局情况该统计数据包含了2021年和2022年中国互联网大厂在消费领域投资布局情况。2022年大厂在消费领域的投资大幅减少。2021-2022年发布时间:2023-01-11

2021年和2022年中国互联网大厂在消费领域投资布局情况该统计数据包含了2021年和2022年中国互联网大厂在消费领域投资布局情况。2022年大厂在消费领域的投资大幅减少。2021-2022年发布时间:2023-01-11 2020年湖南省外商投资企业投资基本情况该数据包含了2020年湖南省外商投资企业投资基本情况。总计本期投资总额为2685839.34万美元。2020年发布时间:2022-03-28

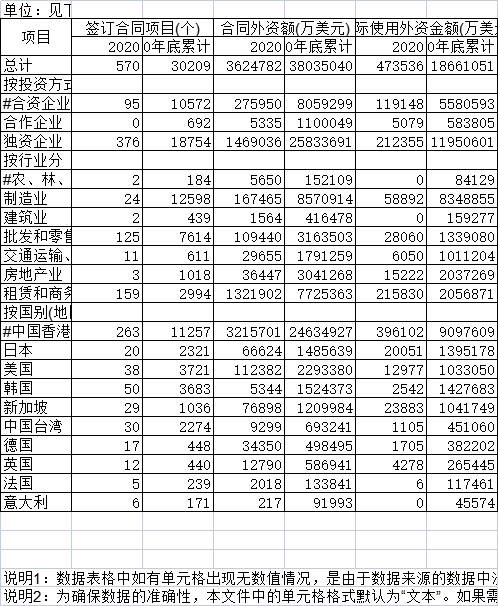

2020年湖南省外商投资企业投资基本情况该数据包含了2020年湖南省外商投资企业投资基本情况。总计本期投资总额为2685839.34万美元。2020年发布时间:2022-03-28 截至2020年天津市外商及港澳台商投资企业投资情况该数据包含了截至2020年天津市外商及港澳台商投资企业投资情况。总计签订合同项目为570个。2020年发布时间:2022-06-27

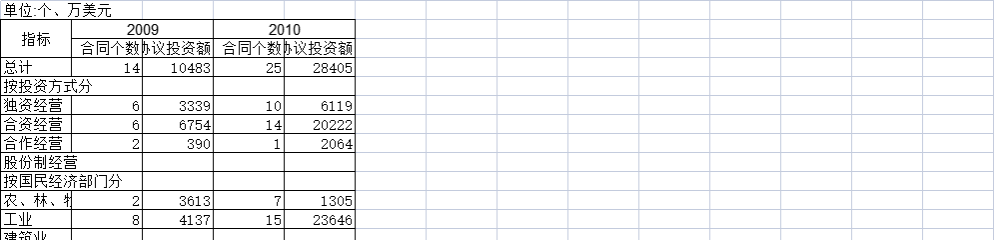

截至2020年天津市外商及港澳台商投资企业投资情况该数据包含了截至2020年天津市外商及港澳台商投资企业投资情况。总计签订合同项目为570个。2020年发布时间:2022-06-27 截至2011年宁夏省外商投资企业协议投资额该数据包含了截至2011年宁夏省外商投资企业协议投资额。总计2009合同个数为14个。2011年发布时间:2021-09-07

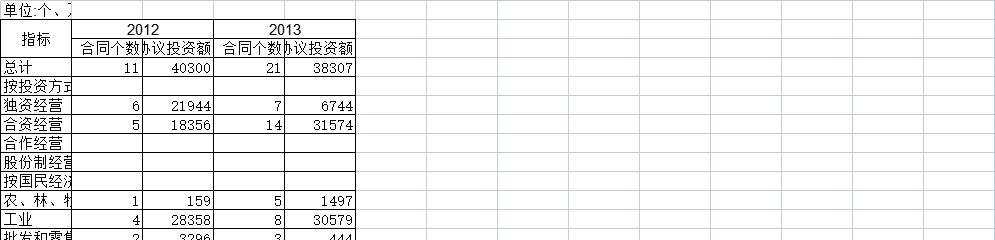

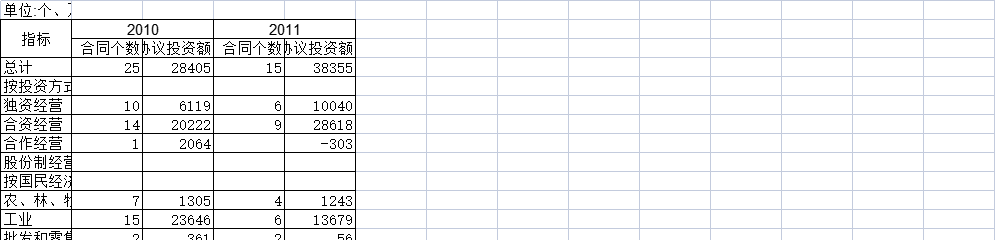

截至2011年宁夏省外商投资企业协议投资额该数据包含了截至2011年宁夏省外商投资企业协议投资额。总计2009合同个数为14个。2011年发布时间:2021-09-07 截至2014年宁夏省外商投资企业协议投资额该数据包含了截至2014年宁夏省外商投资企业协议投资额。总计2012合同个数为11个。2014年发布时间:2021-07-27

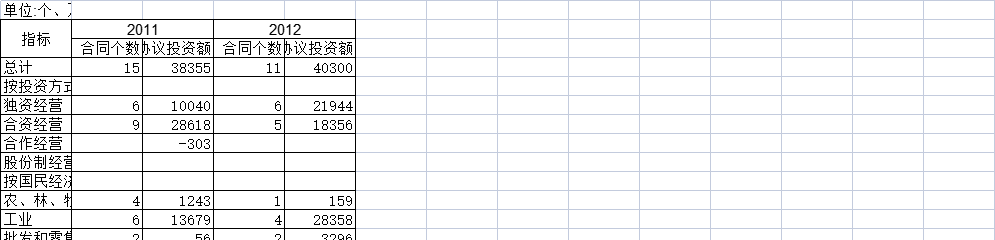

截至2014年宁夏省外商投资企业协议投资额该数据包含了截至2014年宁夏省外商投资企业协议投资额。总计2012合同个数为11个。2014年发布时间:2021-07-27 截至2012年宁夏省外商投资企业协议投资额该数据包含了截至2012年宁夏省外商投资企业协议投资额。总计2010合同个数为25个。2012年发布时间:2021-07-27

截至2012年宁夏省外商投资企业协议投资额该数据包含了截至2012年宁夏省外商投资企业协议投资额。总计2010合同个数为25个。2012年发布时间:2021-07-27 截至2013年宁夏省外商投资企业协议投资额该数据包含了截至2013年宁夏省外商投资企业协议投资额。总计2011合同个数为15个。2013年发布时间:2021-07-27

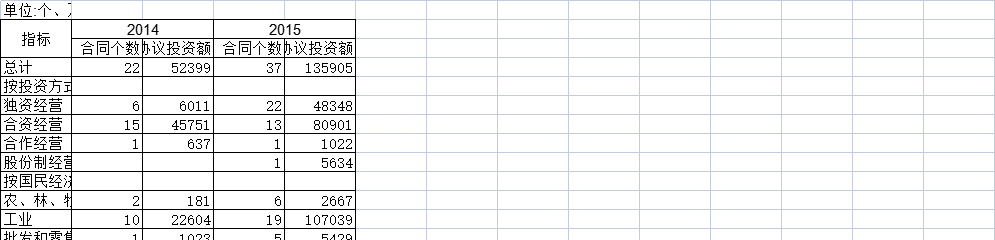

截至2013年宁夏省外商投资企业协议投资额该数据包含了截至2013年宁夏省外商投资企业协议投资额。总计2011合同个数为15个。2013年发布时间:2021-07-27 截至2016年宁夏省外商投资企业协议投资额该数据包含了截至2016年宁夏省外商投资企业协议投资额。总计2014合同个数为22个。2016年发布时间:2021-07-27

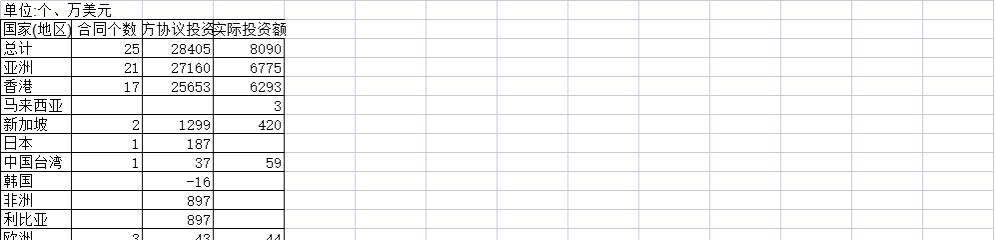

截至2016年宁夏省外商投资企业协议投资额该数据包含了截至2016年宁夏省外商投资企业协议投资额。总计2014合同个数为22个。2016年发布时间:2021-07-27 2013年宁夏省分国别(地区)外商投资企业投资额该数据包含了2013年宁夏省分国别(地区)外商投资企业投资额。总计合同个数为21个。2013年发布时间:2021-07-27

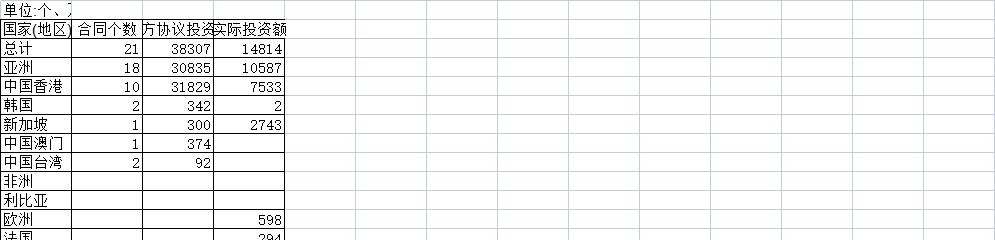

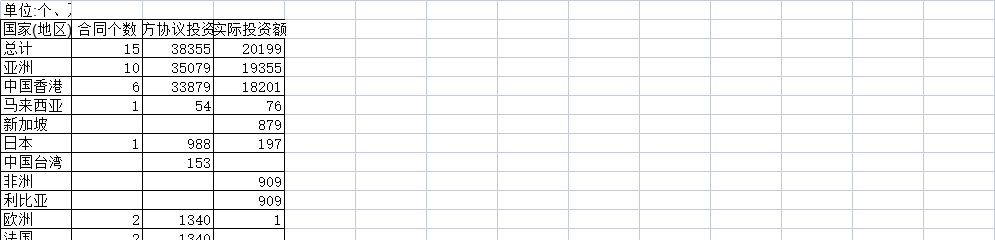

2013年宁夏省分国别(地区)外商投资企业投资额该数据包含了2013年宁夏省分国别(地区)外商投资企业投资额。总计合同个数为21个。2013年发布时间:2021-07-27 2011年宁夏省分国别(地区)外商投资企业投资额该数据包含了2011年宁夏省分国别(地区)外商投资企业投资额。总计合同个数为15个。2011年发布时间:2021-07-27

2011年宁夏省分国别(地区)外商投资企业投资额该数据包含了2011年宁夏省分国别(地区)外商投资企业投资额。总计合同个数为15个。2011年发布时间:2021-07-27 2012年宁夏省分国别(地区)外商投资企业投资额该数据包含了2012年宁夏省分国别(地区)外商投资企业投资额。总计合同个数为11个。2012年发布时间:2021-07-27

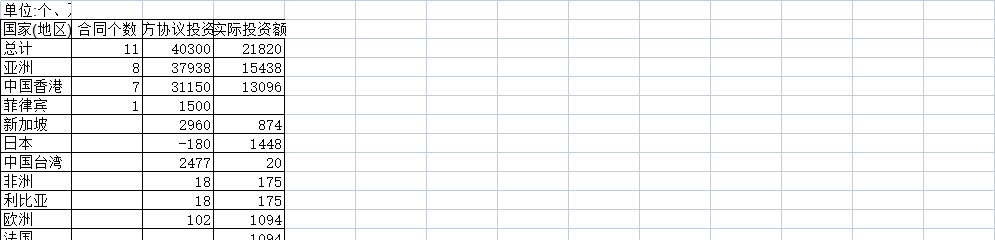

2012年宁夏省分国别(地区)外商投资企业投资额该数据包含了2012年宁夏省分国别(地区)外商投资企业投资额。总计合同个数为11个。2012年发布时间:2021-07-27 2015年宁夏省分国别(地区)外商投资企业投资额该数据包含了2015年宁夏省分国别(地区)外商投资企业投资额。总计合同个数为37个。2015年发布时间:2021-07-27

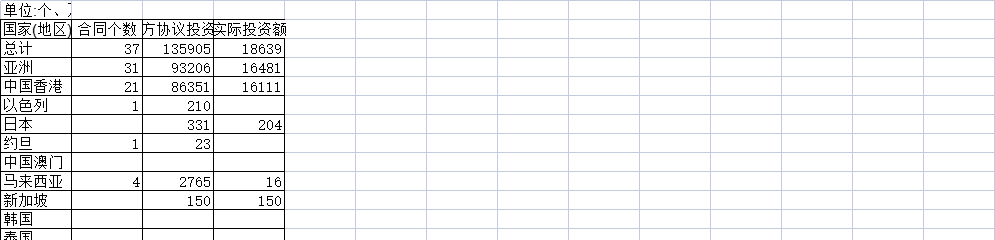

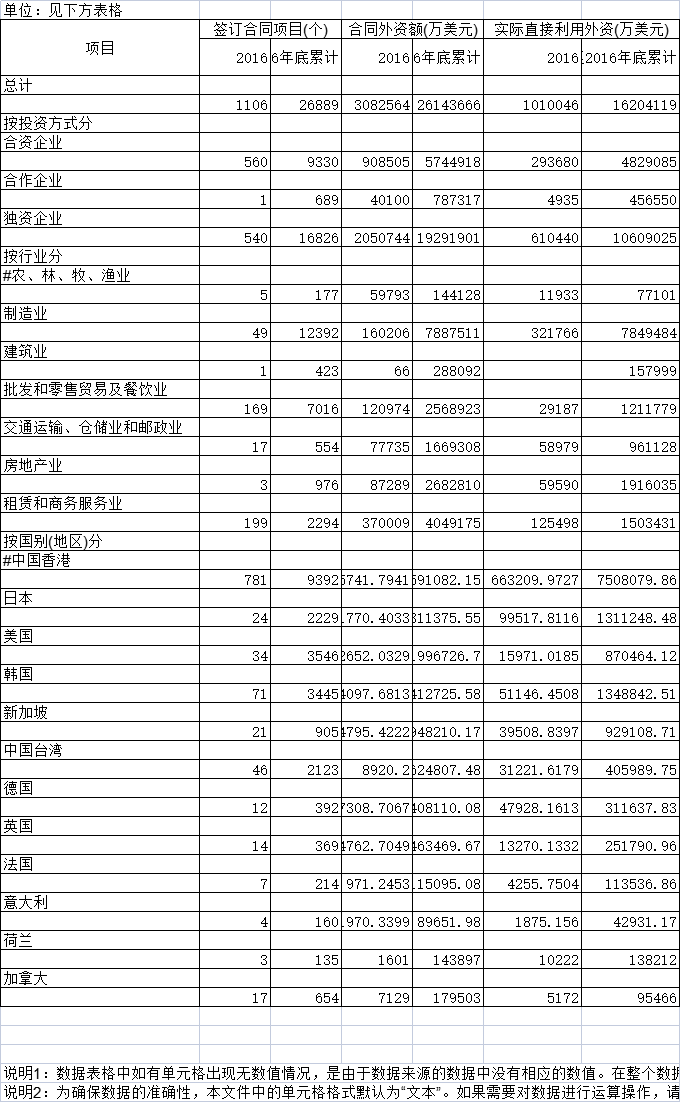

2015年宁夏省分国别(地区)外商投资企业投资额该数据包含了2015年宁夏省分国别(地区)外商投资企业投资额。总计合同个数为37个。2015年发布时间:2021-07-27 2016年天津市外商及港澳台商投资企业投资情况该数据包含了2016年天津市外商及港澳台商投资企业投资情况。签订合同项目为1106个。2016年发布时间:2021-12-29

2016年天津市外商及港澳台商投资企业投资情况该数据包含了2016年天津市外商及港澳台商投资企业投资情况。签订合同项目为1106个。2016年发布时间:2021-12-29 截至2020年福建省外商投资企业工商注册投资总额该数据包含了截至2020年福建省外商投资企业工商注册投资总额。总计2005为7533131.0万美元。2020年发布时间:2022-08-24

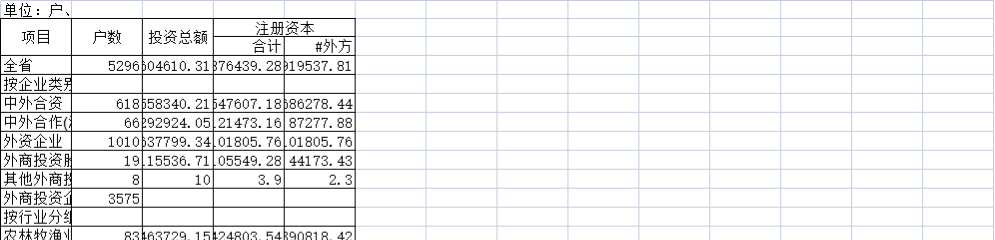

截至2020年福建省外商投资企业工商注册投资总额该数据包含了截至2020年福建省外商投资企业工商注册投资总额。总计2005为7533131.0万美元。2020年发布时间:2022-08-24 2019年黑龙江省外商投资企业户数和投资额该数据包含了2019年黑龙江省外商投资企业户数和投资额。全省户数为5296户、万美元。2019年发布时间:2021-08-23

2019年黑龙江省外商投资企业户数和投资额该数据包含了2019年黑龙江省外商投资企业户数和投资额。全省户数为5296户、万美元。2019年发布时间:2021-08-23 截至2010年宁夏省分国别(地区)外商投资企业投资额该数据包含了截至2010年宁夏省分国别(地区)外商投资企业投资额。总计合同个数为25个。2010年发布时间:2021-09-07

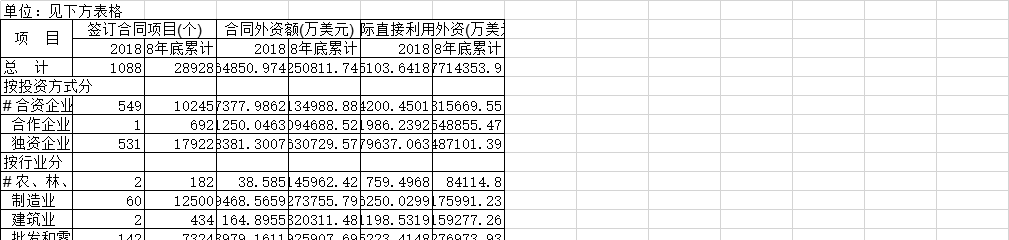

截至2010年宁夏省分国别(地区)外商投资企业投资额该数据包含了截至2010年宁夏省分国别(地区)外商投资企业投资额。总计合同个数为25个。2010年发布时间:2021-09-07 2018年天津外商及港澳台商投资企业投资情况该数据包含了2018年天津外商及港澳台商投资企业投资情况。总计签订合同项目1088个。2018年发布时间:2021-03-10

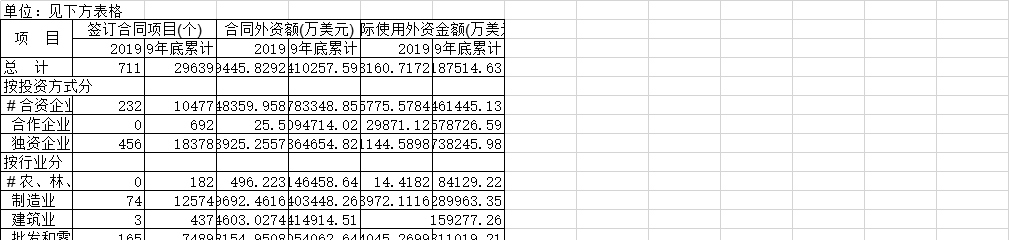

2018年天津外商及港澳台商投资企业投资情况该数据包含了2018年天津外商及港澳台商投资企业投资情况。总计签订合同项目1088个。2018年发布时间:2021-03-10 2019年天津市外商及港澳台商投资企业投资情况该数据包含了2019年天津市外商及港澳台商投资企业投资情况。总计签订合同项目711个。2019年发布时间:2021-03-11

2019年天津市外商及港澳台商投资企业投资情况该数据包含了2019年天津市外商及港澳台商投资企业投资情况。总计签订合同项目711个。2019年发布时间:2021-03-11 截至2020年河北省按投资方式和行业分外商直接投资情况该数据包含了截至2020年河北省按投资方式和行业分外商直接投资情况。合计新设立项目个数为348个。2020年发布时间:2022-06-27

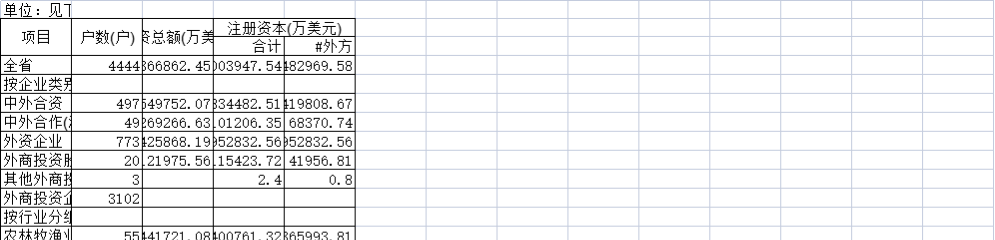

截至2020年河北省按投资方式和行业分外商直接投资情况该数据包含了截至2020年河北省按投资方式和行业分外商直接投资情况。合计新设立项目个数为348个。2020年发布时间:2022-06-27 2017年黑龙江省外商投资企业户数和投资额该数据包含了2017年黑龙江省外商投资企业户数和投资额。全省户数为4444户。2017年发布时间:2021-08-25

2017年黑龙江省外商投资企业户数和投资额该数据包含了2017年黑龙江省外商投资企业户数和投资额。全省户数为4444户。2017年发布时间:2021-08-25